22nd Oct, 2025| 5 Min read.

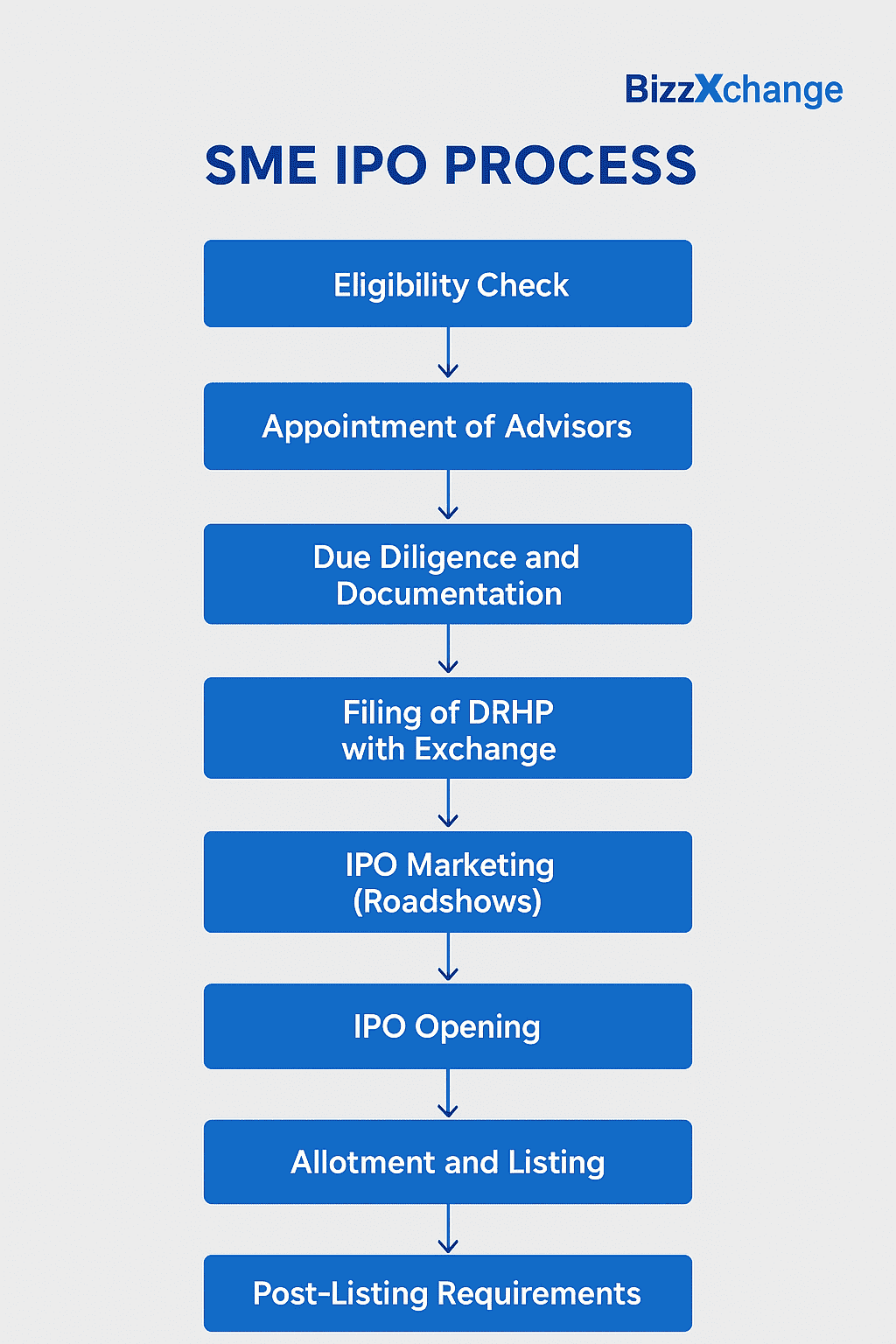

SME IPO issue process

SME IPO understanding

The SME IPO process (Small and Medium Enterprise

Initial Public Offering) is similar to a mainboard IPO but is simplified and

designed for smaller companies that want to raise capital and get listed

on a SME platform of stock exchanges — like BSE SME or NSE

Emerge.

Here’s a clear step-by-step explanation 👇

1. Eligibility Check

Before applying, the SME must meet some basic conditions:

Before applying, a company must ensure it fulfills these

basic conditions:

|

|

|

|

Type of Company |

:Public Limited Company (Private Limited must convert

first) |

|

Post-Issue Paid-up Capital |

:Minimum ₹1 crore and up to ₹25 crore |

|

Track Record / Profitability |

:Positive net worth and profitability in at least 2 of the

last 3 financial years (may vary slightly as per exchange) |

|

Net Tangible Assets |

:Minimum ₹1.5 crore as per latest audited balance sheet |

|

Net Worth |

:Minimum ₹1 crore |

|

Number of Shareholders (Post-Issue) |

:Minimum 50 (to ensure liquidity) |

|

Promoter Holding |

:Should be in demat form and held for at least 3 years

(pre-issue) |

|

Dematerialisation |

:Entire shareholding must be in demat form |

👉 SME IPOs are listed on NSE

Emerge or BSE SME — not on the main board initially.

2. Appointment of Advisors

The company appoints key professionals:

- Merchant

Banker (Lead Manager) – to manage the IPO

- Legal

Advisor – to handle legal documentation

- Registrar

to Issue – to handle applications and allotments

- Auditor

and Company Secretary – for compliance and financial certifications

3. Due Diligence and Documentation

The merchant banker conducts a due diligence check on

the company’s:

- Financials

- Legal

cases

- Promoter

background

- Business

model and risks

Then prepares documents like:

- Draft

Prospectus (DRHP)

- Audited

Financials

- Legal

Reports

4. Filing of DRHP with Exchange

The Draft Red Herring Prospectus (DRHP) is submitted

to the BSE SME or NSE Emerge and SEBI for review.

- Exchanges

check compliance and may ask for clarifications.

- After

approval, the company files the final prospectus.

5. IPO Marketing (Roadshows)

The company and merchant banker conduct investor meetings

and presentations to attract investors — known as roadshows.

6. IPO Opening

The issue opens for public subscription (usually 3–5 days).

Investors (mainly HNI, retail, and institutional) can apply through ASBA

in their banks.

7. Allotment and

Listing

- After

closure, the Registrar finalizes the allotment.

- Shares

are credited to investor demat accounts.

- The

company gets listed on the SME platform (NSE Emerge or BSE

SME).

8. Post-Listing Requirements

After listing, the company must follow SME-specific

compliance, such as:

- Quarterly

financial results

- Annual

reports

- Minimum

public shareholding norms

After 2–3 years of good performance, the company can migrate

to the Main Board (BSE/NSE).